Career oppourtunity

Grow your Independent Financial Adviser business

We offer full compliance peace of mind, back-office services, and institutional technology, so you can focus on delivering exceptional advice. Join a trusted Chartered and Independent firm that helps Advisers build their own business, increase earnings, and scale their practice without sacrificing independence

Whether you’re an experienced Independent Financial Adviser or looking to transition from an employed role to self-employed, Westminster Wealth Management provides the support you need to grow your business.

What you gain

-

At Westminster Wealth Management, we provide the tools and guidance to help Advisers achieve their business goals.

Our support includes structured CPD programmes to keep your knowledge current, access to an experienced supervisor for compliance and best practice, and proven sales tools to help you attract and retain clients. While growth is always in your hands, we give you the resources and infrastructure to make success achievable.

-

Running an advisory business shouldn’t mean drowning in admin.

At Westminster Wealth Management, we streamline your operations with robust central services and full compliance support. From back-office administration and FCA regulatory oversight to technology that simplifies client management, we take care of the heavy lifting so you can focus on delivering exceptional advice.

Our systems are designed to reduce complexity, save time, and keep your practice fully compliant.

-

We bring institutional-grade technology directly to your practice. We’re happy to report that our advisers benefit from enterprise-level platforms at discounted rates, giving you the tools to deliver a seamless client experience. From advanced portfolio management systems to secure communication and reporting tools, everything is backed by our in-house experts who provide hands-on support.

This means you can stay competitive, efficient, and compliant while focusing on what matters most: your clients.

-

Our commitment to putting clients first is reflected in our Chartered status which we’ve held for over a decade.

We provide Advisers with a dedicated compliance support team and a Compliance Adviser Officer who bridges the gap between your business and regulatory requirements. With monthly rules and regulations training, proactive oversight, and clear guidance, you can focus on growing your practice knowing your compliance is in expert hands.

-

Our community of 60+ Independent Financial Advisers shares a core value: excellence in client outcomes. Alongside your independence, you’ll have access to a team of experts across multiple disciplines—so there’s always someone to turn to for guidance.

As one of our newly joined Advisers put it:

‘Being self-employed at Westminster means keeping the social perks of being employed.’

What you keep

-

At Westminster Wealth Management, we believe your clients are your most valuable asset which is why, for all self generated clients, we guarantee 100% client ownership

Unlike many firms that restrict Adviser autonomy, we ensure you retain full control of your client relationships. This means you can build lasting trust, protect your income stream, and grow your practice without limitations.

Our model empowers Advisers to operate independently while benefiting from the compliance, technology, and support they need to succeed.

-

We respect the way you work which is why Advisers maintain full control over their own advice methodology and client approach.

Our role is to provide the compliance, technology, and business support ensuring you stay true to your advice principles while growing your practice with confidence.

This freedom ensures you can stay true to your principles while growing your practice with confidence.

-

At Westminster Wealth Management, we ensure you keep your professional identity while accessing the resources and support of a trusted team. You remain the face of your business, free to build client relationships and scale your business, while we provide the compliance, technology, and growth tools to help you succeed.

-

Your hard work should pay off today and in the future. At Westminster Wealth Management, we guarantee an exit value for the practice you build, giving you financial security when it’s time to retire or move on. This means the client relationships and business you’ve grown translate into a tangible, agreed-upon value, ensuring your legacy and income are protected. It’s our way of helping Advisers plan not just for their clients’ futures, but for their own.

-

You will have complete ownership of your practice: your clients, your methodology, and your future.

Unlike restrictive models, we give Advisers full autonomy to build and grow their business without compromise.

You retain control over every aspect of your client relationships and methodology, while benefiting from our compliance, technology, and growth support.

Commitment to Chartered status

We believe Chartered status is the mark of true professionalism within the Financial Service industry. That’s why we only partner with Advisers who are already Chartered or committed to achieving it within two years.

This standard reflects our dedication to excellence in client outcomes. To help you reach that goal, we provide structured CPD, mentoring, and supervisor support every step of the way.

We’ve been Chartered for over a decade

Truly independent

Independent Advisers

When we talk to Advisers external to Westminster Wealth Management they ask if our Independent Financial Advisers are genuinely Independent. We’re glad to announce that they are! We have no restrictions, are not tied to any external stakeholder, and push no in-house products. You’re free to select the most suitable product solution for your client to ensure optimal client outcomes.

Independent Firm

Not only are our Advisers independent, but so are we as a firm. We offer a truly unique proposition: all-of-market access combined with a fully in-house service.

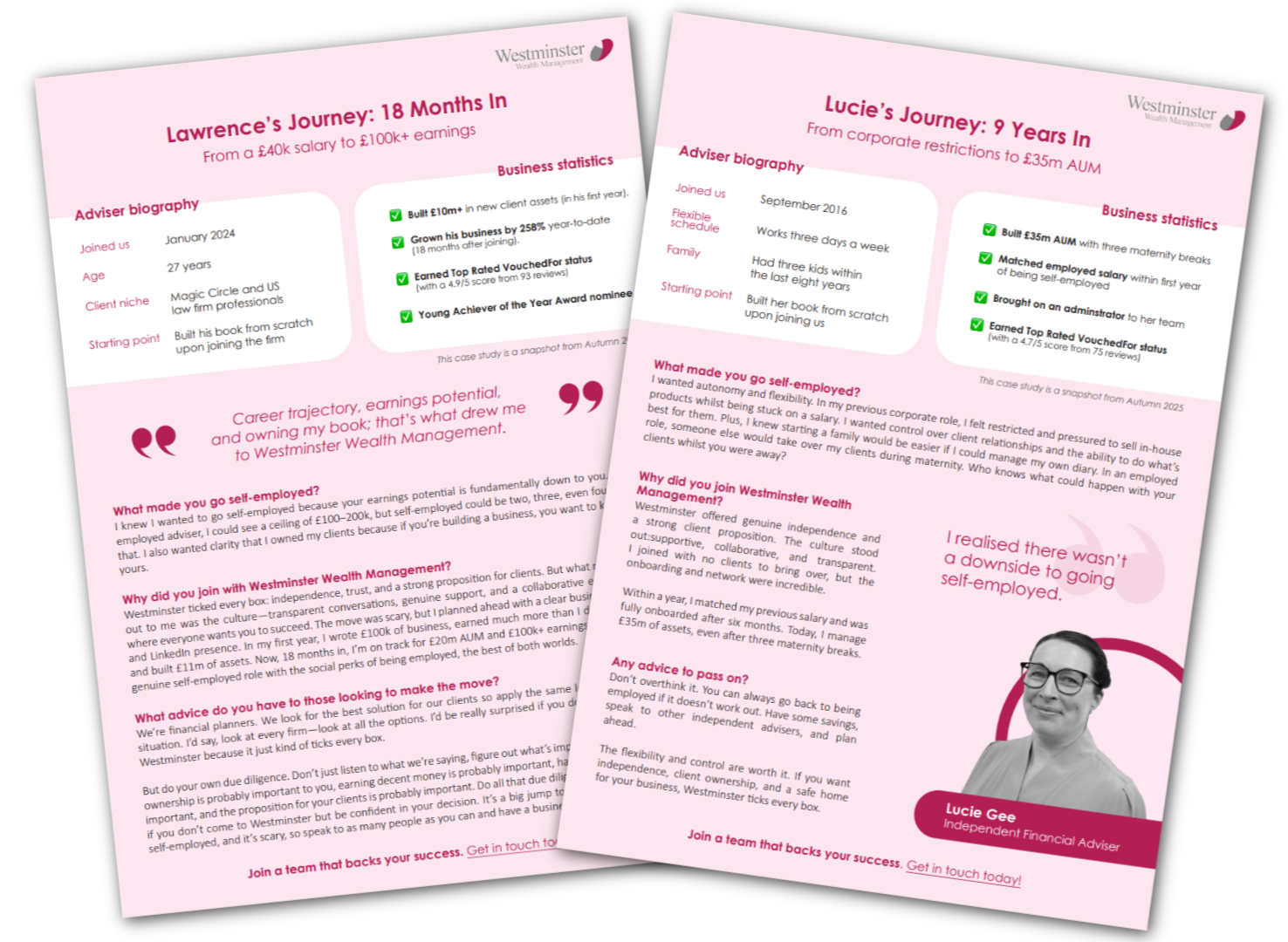

Being self-employed gave me control over my client relationships and the ability to do what’s best for them.

Lucie Gee, Independent Financial Adviser

Get in touch to hear more

If you're looking to grow your business rapidly in a supportive, forward-thinking environment, one of the best places to give and receive financial advice in the UK—we’d love to hear from you.

BY SUBMITTING THIS FORM you voluntarily choose to provide personal details to us via this website. Personal information will be treated as confidential by us and held in accordance with the Data Protection Act 2018.

You agree that such personal information may be used to provide you with details of services and products in writing, by email or by telephone.

Our Privacy Policy can be found here.

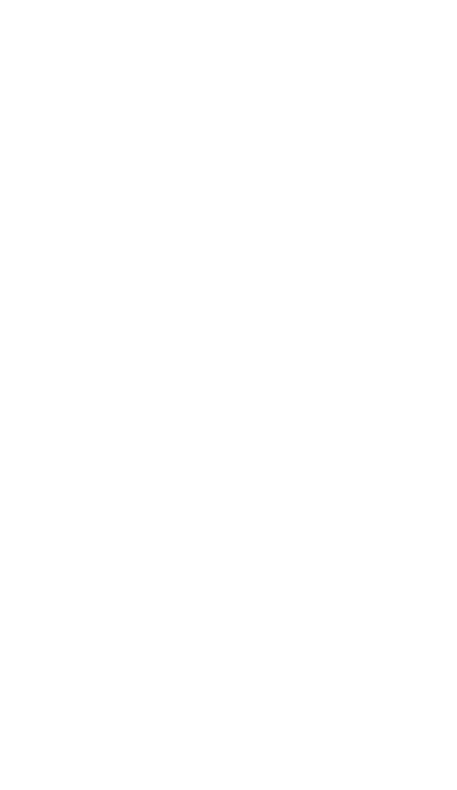

A word of advice from our Advisers

What advice would you give employed advisers?

We're financial planners. We look for the best solution for our clients - so apply the same logic to your own situation. I’d say, look at a selection of firms. Explore your options. I’d be really surprised if you don’t come back to Westminster because it just kind of ticks every box. But do your own due diligence.

Don’t just listen to what we’re saying; figure out what’s important to you.

Client ownership is probably important to you, earning decent money is probably important, having trust is probably important, and the proposition for your clients is probably important.

Do all that due diligence. I’d be surprised if you don’t come to Westminster, but be so confident in your decision. It’s a big jump to go from employed to self-employed, and it’s scary, so speak to as many people as you can and have a business plan.

Lawrence Bearman (joined March 2023)

What advice would you give employed advisers?

Don’t overthink it. You can always go back to being employed if it doesn’t work out. Have some savings, speak to other independent advisers, and plan ahead.

The flexibility and control are worth it. If you want independence, client ownership, and a safe home for your business, Westminster ticks every box.

Lucie Gee (joined Sept 2016)

What advice would you give employed advisers?

Don’t fear failure. I worried about clients not following me, but once I started speaking to them, confidence grew. Age and experience help. People trust you more as you get older, and your network matures.

There’s a huge transfer of wealth coming, and if you’re proactive, the opportunity is massive. Self-employed means more time for clients and family, and less corporate admin. You’ll be amazed how much you can achieve when you focus on the right things.

Dan Dando (joined July 2019)

Hear from our Advisers

We’re happy to arrange a conversation with one of our Partners or Advisers so you can hear first-hand what it’s like to join Westminster Wealth Management.

To give you a real insight, we’ve also created three detailed case studies showcasing Advisers at different stages of their journey. From transitioning to self-employed, to scaling an established practice, to planning for retirement. Each story highlights how their business has evolved since joining us.